Trust and estate administration refers to the management and distribution of assets and properties held in a trust or estate after the death of the owner. This process involves ensuring that the assets are distributed to the intended beneficiaries according to the wishes of the deceased, while also complying with legal and tax requirements. Trust and estate administration may include tasks such as filing legal documents, managing and distributing assets, resolving disputes among beneficiaries, ensuring compliance with tax and legal requirements, and providing guidance and advice to trustees or executors. Trust and estate administration is typically overseen by a lawyer, financial advisor, or other professional with expertise in this area. The goal of trust and estate administration is to ensure that the assets are distributed in an orderly and fair manner while minimizing costs and maximizing the value of the estate for the beneficiaries.

Contact us for more information or to schedule a call.

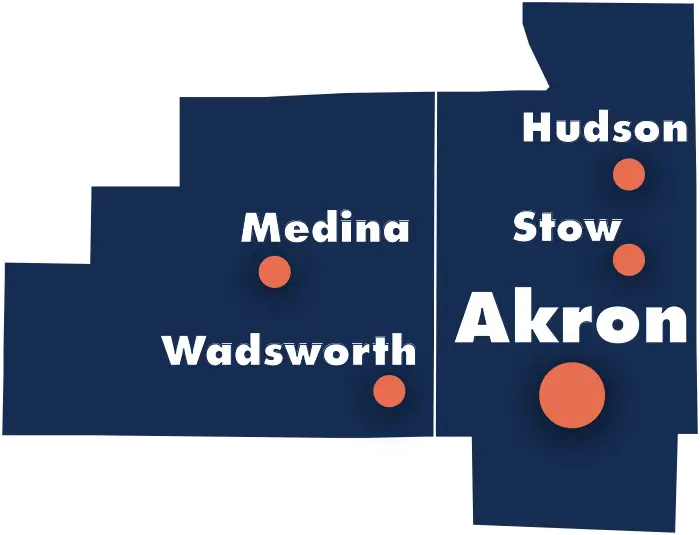

Areas Served

John Hoffman Law serves people with legal needs throughout Northeast Ohio in Summit and Medina Counties.

Attorney John Hoffman is ready to help you with estate planning and medicaid planning. Let John Hoffman Law put our experience and diligent legal representation to work for you. Contact us today to learn how John Hoffman Law can help you.